Synopsis: Saregama India is in focus after it approved a strategic investment of Rs 325 crore in Bhansali Productions, thus securing the exclusive future music rights and expanding into premium films and OTT content.

The shares of this company, which is the oldest music label company in India, are in focus after the company made a significant investment in one of the leading production houses in India. In this article, we will dive more into the details.

With a market capitalisation of Rs 7,312 crore, the shares of Saregama India Ltd. closed at Rs 379.50 per share, up 0.86 percent from its previous day’s closing price of Rs 376.25 per share. Over the past five years, the stock has delivered a robust return of 424 percent, outperforming NIFTY 50’s positive return of 88 percent.

About the Acquisition

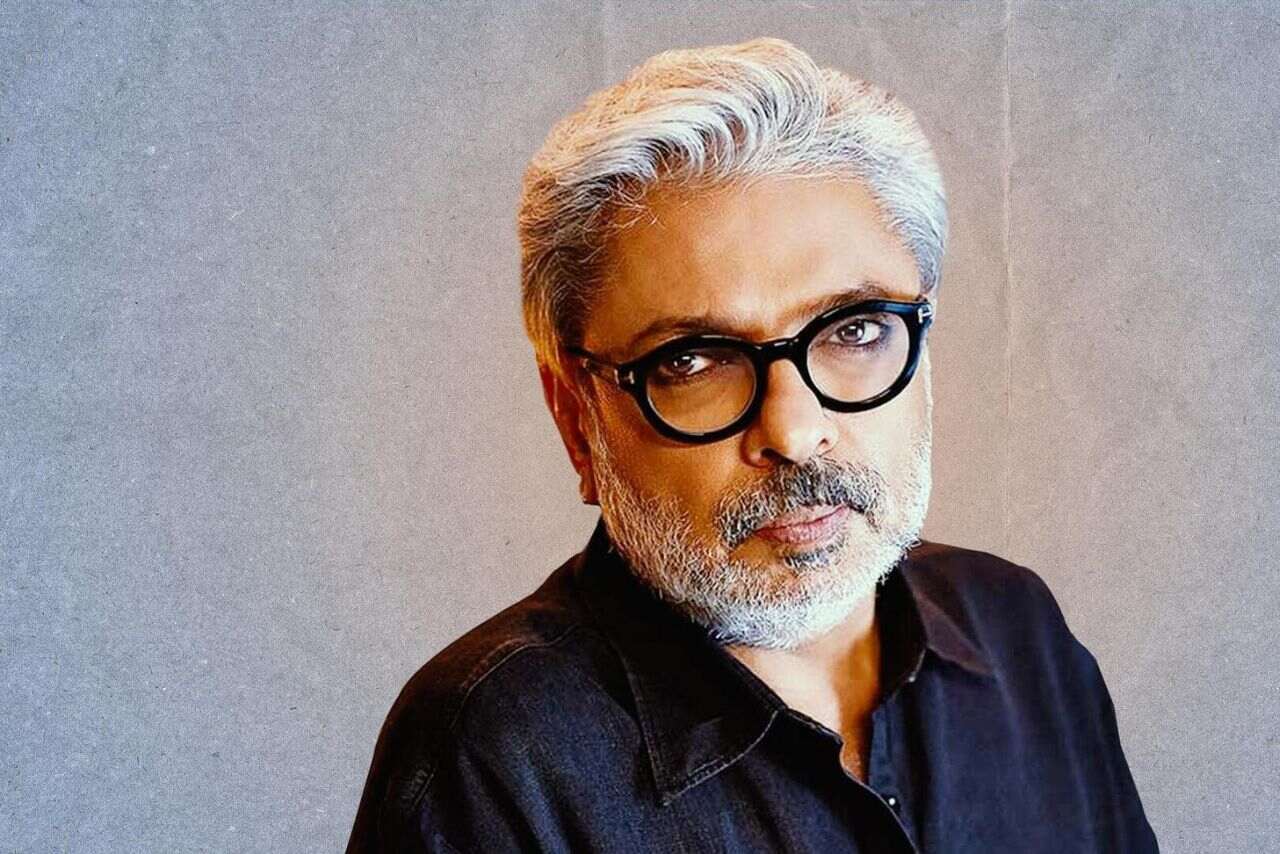

Saregama India Ltd has given the green light to a strategic investment in Bhansali Productions Private Limited, the film production company of the famous director Sanjay Leela Bhansali.

As part of the transaction, Saregama will inject Rs 325 crore initially in the company by subscribing to compulsory convertible preference shares, which later on can be converted into equity. The company, however, has the right to raise its shareholding in Bhansali Productions to 51 percent, thus having a majority stake.

The primary purpose of this acquisition is to deepen Saregama’s music licensing business and to be present in the video and long-form content segment, like films and web series. Saregama, through a separate music rights deal, will become the owner of the music made and produced by Bhansali Productions, thus ensuring the availability of the most valuable and premium content.

Bhansali Productions has made a significant mark in the media and entertainment industry through hit films and series such as Bajirao Mastani, Padmaavat, Gangubai Kathiawadi, and Heeramandi. For Saregama, this is a step that opens doors to long-term content visibility, more substantial monetisation avenues across music, OTT, and digital platforms, and consolidates its position as a leader in India’s entertainment ecosystem.

Target Highlights

As a part of the agreement, Bhansali Productions is going to give Saregama the sole right to license the film music of all its future films.

Thus, Saregama will be the one to receive a continuous flow of fresh, premium, and high-value music content without the need to go through a competitive bidding process. By doing so, Saregama keeps its music acquisition costs in check while at the same time consolidating its position as a leader in music licensing.

The move is likely to make Saregama’s earnings per share (EPS) grow positively by the financial year 2027. The management has also suggested that there will be margin improvements in both the music and the video segments.

Bhansali Productions, at the same time, is doing well financially as it reported a revenue of Rs 304 crore and a net profit of Rs 45 crore in the fiscal year 2025, which is mainly due to the strong pipeline of more than 10 upcoming films over the next three years. From a strategic point of view, Saregama is also going to reduce its in-house film production gradually over the next one or two years and concentrate on more partnership deals like this, which will result in better capital allocation and less risk of execution.

Financial and Other Highlights

Saregama India has reported an operating revenue of Rs 230 crore in Q2 FY26, representing a 5 percent decline compared to Rs 242 crore in Q2 FY25. However, on a quarter-on-quarter basis, it grew by 11 percent from Rs 207 crore.

Regarding its profitability, it reported a net profit of Rs 44 crore in Q2 FY26, a decline of 2 percent as compared to Rs 45 crore in Q2 FY25. However, on a quarter-on-quarter basis, it grew by 19 percent from Rs 37 crore.

Saregama India Ltd., part of the RP Sanjiv Goenka Group, is India’s oldest music label and a key player in films and TV content. It owns one of the largest Indian music catalogues and also produces multi-language shows and movies. The company is known for products like Carvaan and its film division, Yoodlee Films.

Written by Satyajeet Mukherjee

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.