From Camden and Cherry Hill to Trenton and the Jersey Shore, what about life in New Jersey do you want WHYY News to cover? Let us know.

Conner Strong & Buckelew, an insurance company founded by South Jersey Democratic power broker George E. Norcross III, took over several health insurance funds, or HIFs, in violation of conflict-of-interest rules and public contracting laws, according to a report from the New Jersey Office of the State Comptroller.

The report, released Tuesday, found that Conner Strong & Buckelew, CSB, and another company “improperly gained control” of the contracting processes, influencing how contracts are written, awarded and priced. In some instances, they allegedly competed for some of the same government contracts that they would win, according to the report.

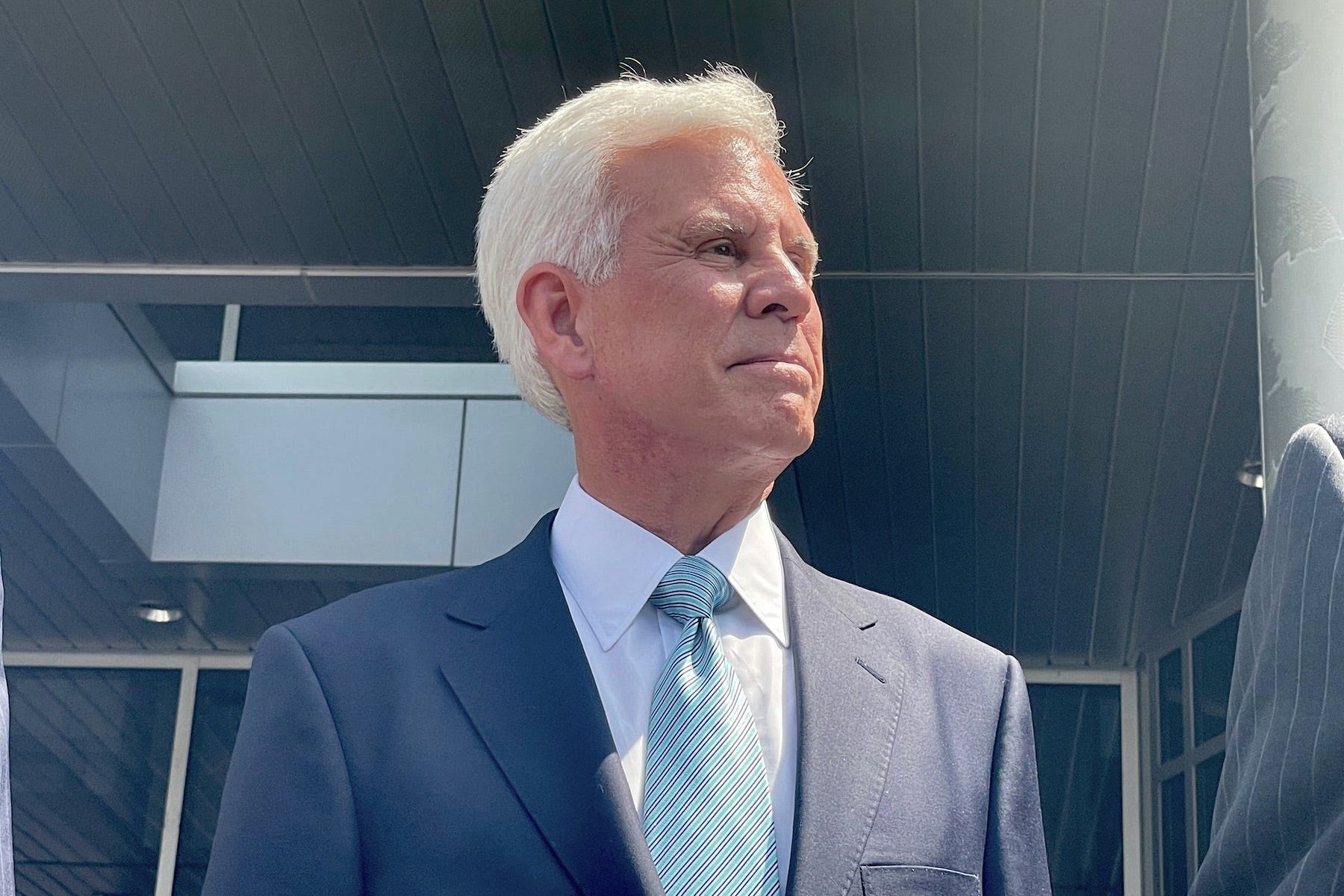

Norcross is CSB’s executive chairman. He took a leave of absence last year after he and others were charged with racketeering in a scheme to take control of Camden’s waterfront properties. Though the indictment was dismissed in February, an appeal remains before the Appellate Division of New Jersey Superior Court. Norcross has denied any wrongdoing.

“There is no clearer conflict of interest than when a company writes the [request for proposal], reviews the bids, and then steers the contract to itself,” said Acting State Comptroller Kevin Walsh. “What makes this worse is that the vendor concealed from the state and its public entity clients that it was operating on all sides of contracting processes that are supposed to protect taxpayer funds.”

All involved entities have disputed that any laws were violated and claim there is no conflict of interest, according to the report. The State Comptroller’s Office findings come after a year-long review that included interviews with HIF chairpersons, and representatives from CSB and Perma Risk Management Services.

Contracts for three HIFs have improper ties to Norcross firms

HIFs enable municipalities and school boards to collaborate and secure health benefits for their employees at lower rates than they would individually.

The Comptroller’s Office was reviewing major proposed contracts from three funds — Southern New Jersey Regional Employee Benefits Fund, Schools Health Insurance Fund and Municipal Reinsurance Health Insurance Fund — when it found violations of public contractions laws, improper efforts to steer contracts to preferred vendors, longstanding undisclosed conflicts of interest and the use of a fake public entity to attract business.

CSB and Perma, a related entity according to the report, manage the daily operations of many of these health insurance funds and provide consulting, brokerage services and administration.

“[The State Comptroller’s Office] found that CSB and PERMA are effectively the same business operating under two names,” the report stated. “Their employees overlap, they share leadership, and the same people work on both sides of the contracts.”

The report also found that the entities assisted in writing the rules for how a contract will be awarded, then compete for and win the same contract.

“These are classic examples of conflicts of interest, in which a company both influences the decision-making process and stands to benefit from it by steering the contract to itself,” the report said.

Of the 10 insurance funds that the State Comptroller’s Office is aware of operating in New Jersey, nine of them are managed by firms connected to Norcross.